-

3Press review

Thanks to the implementation of the Crédit Agricole group's Human Project, Crédit Agricole Consumer Finance is certified for the first time Best Workplaces® in France and is one of the top 10 companies more than 2,500 employees where it is good to work

Crédit Agricole Consumer Finance, based on a survey carried out among its 3,000 employees in France have joined the community of companies labeled Best Workplaces® 2024. This label distinguishes organizations that place the employee experience at the heart of their purpose and their performance. It rewards the initiatives taken by CA Consumer Finance and which are part of the Human Project of the Crédit Agricole group, initiated by Crédit Agricole SA and the Regional Banks, and aimed at the managerial, cultural and human transformation of the group.Consult the press release

2024/03/13

Crédit Agricole Consumer Finance

A European leader in consumer financing

Crédit Agricole Consumer Finance, Crédit Agricole Group’s branch specialized in consumer credit and provider for all mobility solution.

Credit Agricole Consumer Finance offers through all distribution channels - direct sales, point of sale financing and e-commerce platforms (automotive and household equipment...) - a wide range of financing solutions (instalment loans, revolving credit, leasing and loan consolidation) and associated services including split payment solutions, insurance and mobility solutions, with the objective of meeting the energy transition challenges in mobility, housing and consumption.

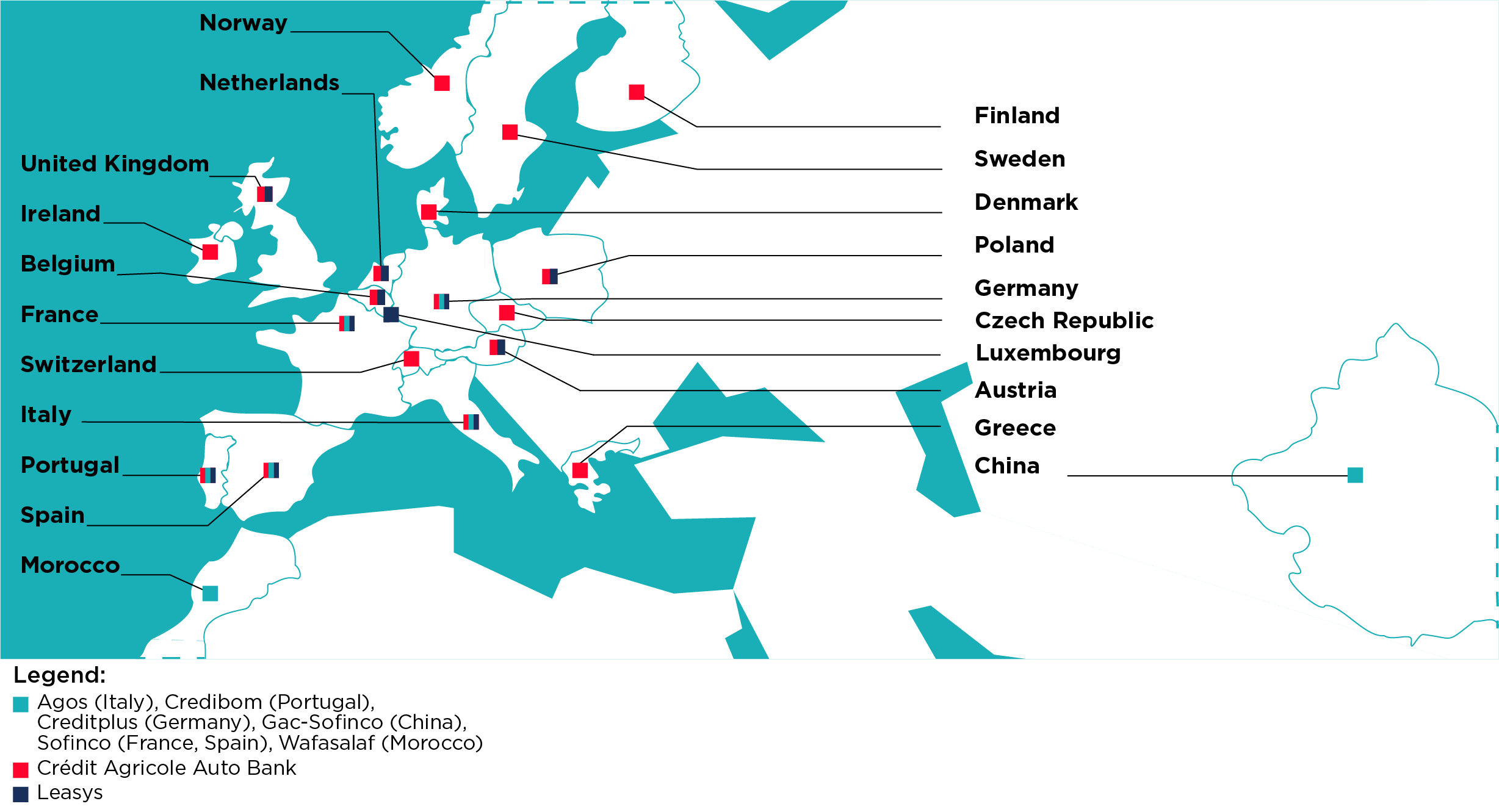

Its financing solutions and services are distributed in France via Sofinco, in Italy via Agos, in Germany via Creditplus, in Portugal via Credibom, in Spain via Sofinco Spain, in Morocco via Wafasalaf, and in China via GAC-Sofinco (car financing only).

Credit Agricole Consumer Finance aims to be a leader in green mobility in Europe and offers a continuum of all mobility solutions in 22 countries (leasing, rental, subscription, car sharing, charging points...). It builds on the joint venture with Stellantis, the 100% integration of CA Auto Bank (ex FCA Bank) and Drivalia and the development of car financing in its historical entities in Europe and in the Credit Agricole Regional Banks and at LCL via Agilauto.

Crédit Agricole Consumer Finance is working every day in the interest of its 17.2 million customers and society at large. By December 31st 2022, CA Consumer Finance was managing €113 billion of outstandings.

17.2 million

customers

€113 billion

of managed outstandings at the end of 2023

+ 10 000

employees

€2.6 billion

in net banking income at the end of 2023

International presence

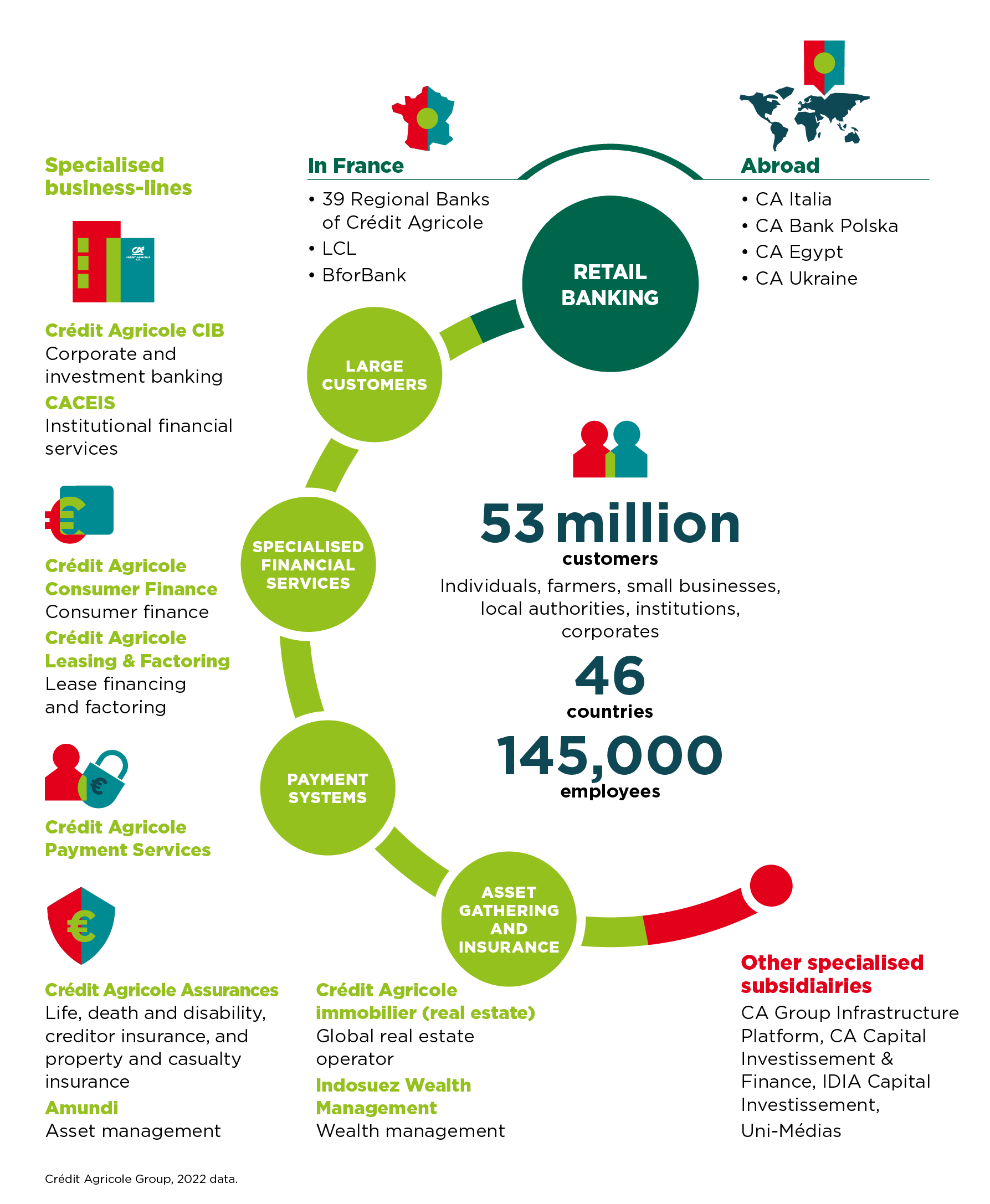

The Crédit Agricole group

Crédit Agricole’s unique customer-focused universal banking model is based on the close association between its retail banking and its specialized business lines. Together, we offer all our customers, via all channels, a complete range of banking products and services suited to their needs.

The Raison d’Être of the Crédit Agricole Group

WORKING EVERY DAY IN THE INTEREST OF OUR CUSTOMERS AND SOCIETY

Crédit Agricole’s end purpose is to be a trusted partner to all its customers:

- Its solid position and the diversity of its expertise enable CA to offer all its customers ongoing support on a daily basis and for their projects in life, in particular by helping them to guard against uncertainties and to plan for the long term.

- Crédit Agricole is committed to seeking out and protecting its customers’ interests in all it does. It advises them with transparency, loyalty and pedagogy.

- It places human responsibility at the heart of its model: it is committed to helping all its customers benefit from the best technological practices, while guaranteeing them access to competent, available local teams that can ensure all aspects of the customer relationship.

Proud of its cooperative and mutualist identity and drawing on a governance representing its customers, Crédit Agricole:

- Supporting the economy, entrepreneurship and innovation in France and abroad: it is naturally committed to supporting its regions.

- It takes intentional action in societal and environment fields by supporting progress and transformations.

- It serves everyone: from the most modest to the wealthiest households, from local professionals to large international companies. This is how Crédit Agricole demonstrates its usefulness and availability to its customers, and the commitment of its 147,000 employees to excellence in customer relations and operations.